For a single maturity, European call prices encode the risk-neutral distribution of the underlying. You can turn them into Monte Carlo samples without fitting a model or estimating a density.

For strikes ![]() with call prices

with call prices ![]() , define

, define

![]()

This is a discrete approximation of the cumulative distribution function of ![]() .

.

To sample:

- Draw

- Find

such that

such that

- Set

![]()

Repeat for as many samples as needed.

This produces risk-neutral samples directly from observed call prices using only simple finite differences. It’s fully model-free, requires no volatility surface fitting, and preserves arbitrage constraints!

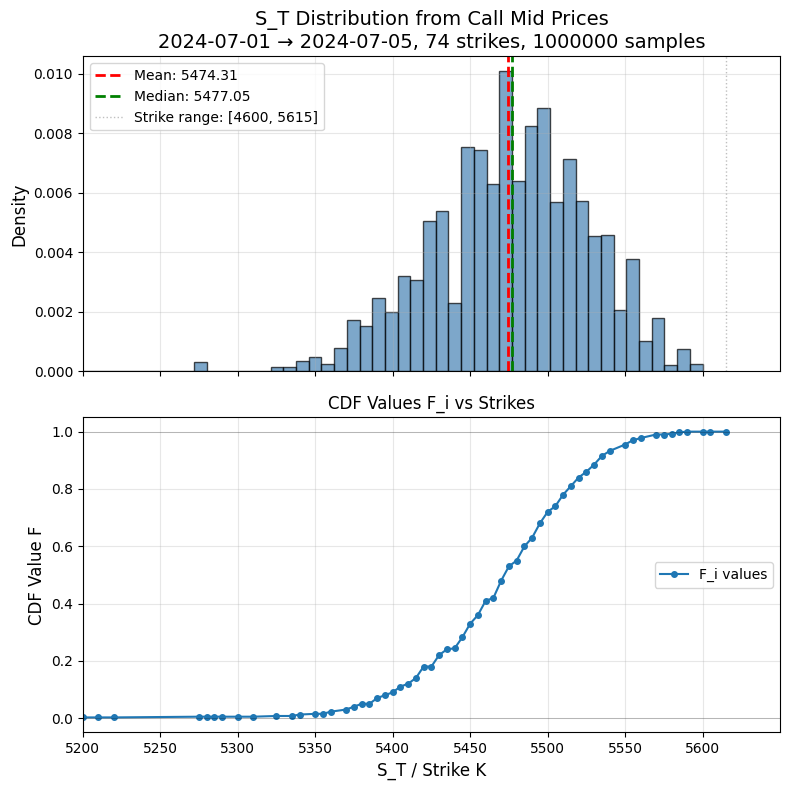

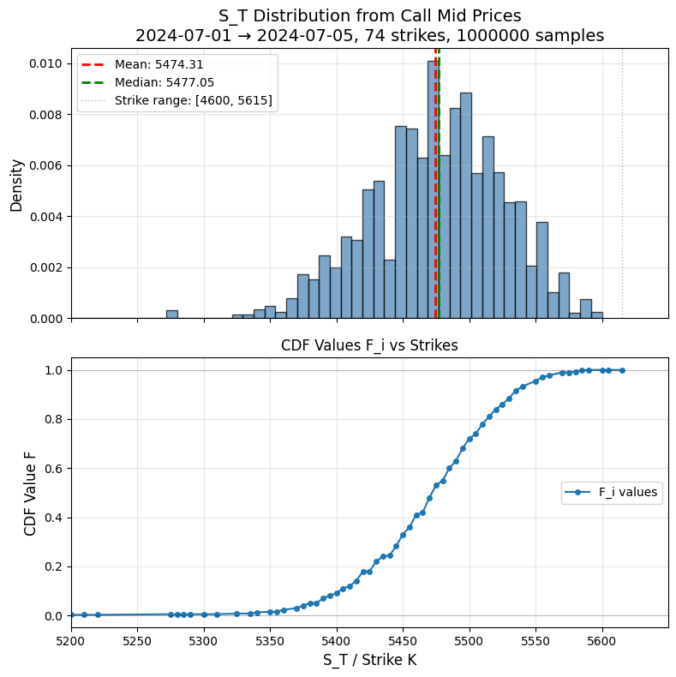

Below and example results from S&P500 option prices: