We’ve released a new open dataset on Hugging Face: GARCH Densities, a large-scale benchmark for density estimation, option pricing, and risk modeling in quantitative finance.

Created with Paul Wilmott, this dataset contains simulations from the GJR-GARCH model with Hansen skewed-t innovations. Each row links a parameter set

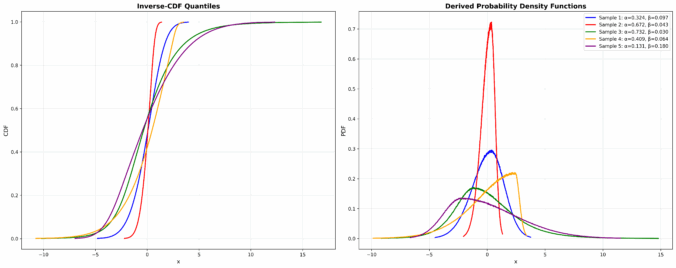

![]()

to the inverse-CDF quantiles of terminal returns over multiple maturities.

Dataset highlights:

- ~1,000 trillion simulated price paths across 6D parameter space

- Quantiles of normalized returns at 512 probability levels

- Low-discrepancy Sobol sampling under

- zstd-compressed Parquet shards (~145 MB each, streaming-friendly)

- CC-BY-4.0 licensed — free for academic and commercial use

Applications:

- Learning

return distributions (pretrained pricing models)

return distributions (pretrained pricing models) - Fast neural surrogates for Monte Carlo simulation

- Option pricing, VaR/CVaR, and volatility surface modeling

- Benchmarking generative and density estimation models

Example usage:

from datasets import load_dataset

ds = load_dataset("sitmo/garch_densities")

train, test = ds["train"], ds["test"]

print(train)

print(train.features)

PyTorch integration:

import torch

from torch.utils.data import DataLoader

param_cols = ["alpha","gamma","beta","var0","eta","lam","ti"]

train = train.with_format("torch", columns=param_cols + ["x"])

loader = DataLoader(train, batch_size=256, shuffle=True)

batch = next(iter(loader))

params, targets = torch.stack([batch[c] for c in param_cols], 1), batch["x"]

print(params.shape, targets.shape)

Goal: accelerate research on pretrained neural pricing models and scientific foundation models in finance — replacing slow Monte Carlo with fast, learned surrogates.

We’d love to see how researchers use this dataset. If you find it useful, consider sharing it or referencing it in your work.

License: CC-BY-4.0

Authors: Thijs van den Berg & Paul Wilmott

Link: https://huggingface.co/datasets/sitmo/garch_densities